Eurobank Cyprus, a subsidiary of Eurobank Group, is an influential figure in Cyprus's financial landscape. Famed for its innovative ethos and customer-centric approach, the bank caters to individuals, businesses, and corporations. Embracing change, Eurobank Cyprus adopted a transformative journey to streamline and elevate its cheque-clearing operations. Eurobank Cyprus embarked on a mission to modernize its cheque-clearing process in a world of perpetual financial evolution. Committed to delivering top-tier banking experiences, Eurobank Cyprus partnered with Parallax Works to tailor a savvy solution. SmartClear - a transformative web application in check clearing, tailored to meet Eurobank Cyprus's needs and the demands of the Temenos T24 core banking system.

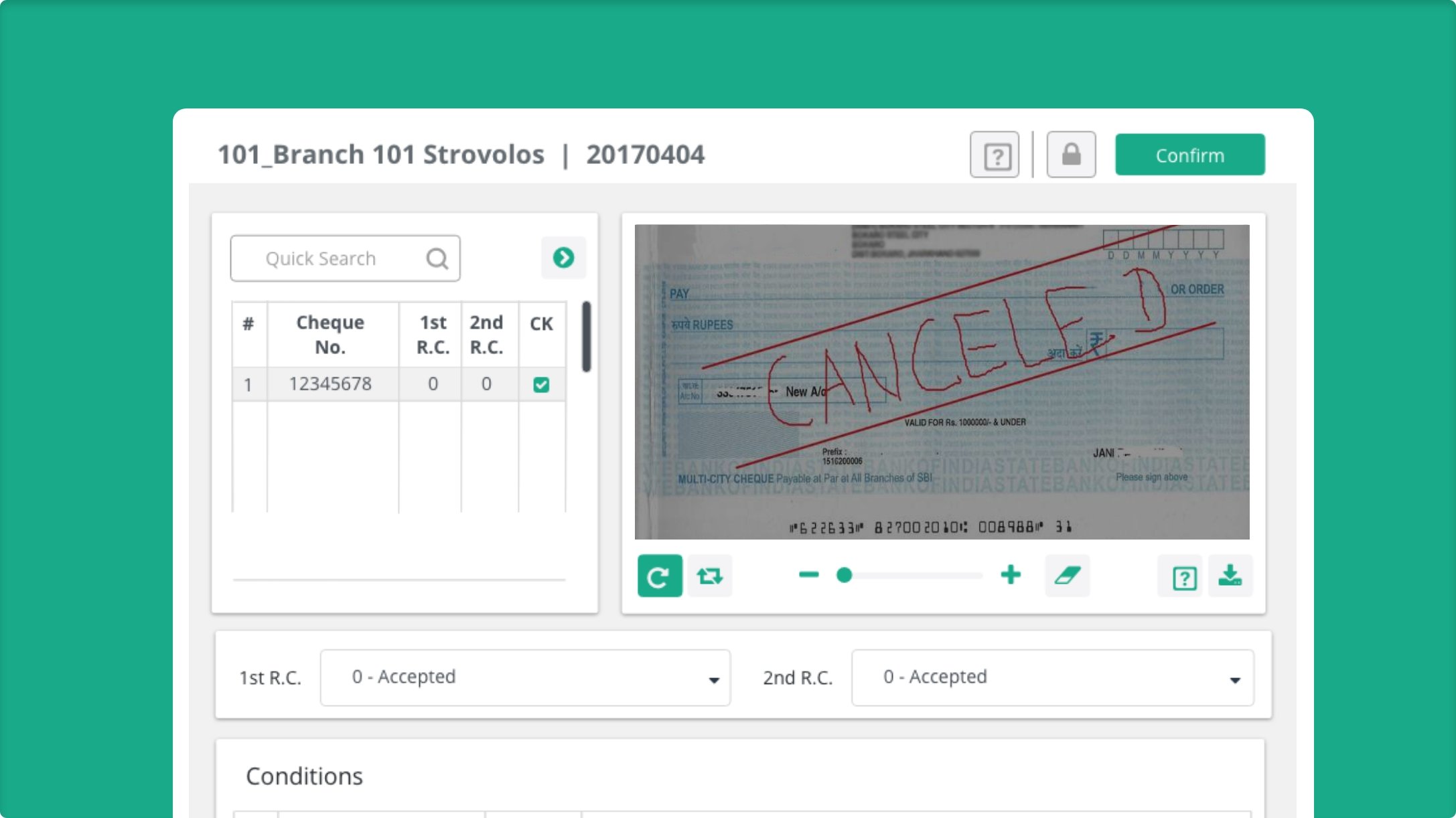

Project Unveiled - SmartClear: Powering Effortless Cheque Clearing for Eurobank Cyprus.

In pursuit of unparalleled efficiency, Eurobank Cyprus partnered with Parallax Works to customise SmartClear to meet its specific needs. This bespoke Cheque Clearing Solution was engineered to expedite the clearing process while ensuring precision and security, aligning Eurobank Cyprus with the pinnacle of banking innovation.

Challenges to Surmount: The antiquated manual cheque-clearing process presented Eurobank Cyprus with challenges.

Manual Processing: Manual cheque processing translated to delays, errors, and escalating operational expenses.

Security Concerns: Data security during the clearing process emerged as a paramount concern.

Customer Expectations: Customers demanded swift clearing times and complete transparency in the digital age.

SmartClear - Tailored Innovation: In a collaborative effort, Parallax Works & Eurobank Cyprus introduced:

Automation Processing: SmartClear automated the cheque-clearing process, curbing errors and manual interventions.

API Integration with Temenos - T24: The solution seamlessly integrated with Eurobank Cyprus's core banking system, Temenos T24, with real-time data exchange via APIs.

Real-time Tracking: Customers and bank staff gained real-time visibility into the clearing process, fostering transparency and customer confidence.

Enhanced Security: SmartClear implemented stringent security measures to safeguard sensitive data, bolstering protection against fraudulent activities.

Effortless Integration: The solution seamlessly integrated with Eurobank Cyprus's existing infrastructure, ensuring a smooth transition.

Resonant Results: The impact of SmartClear was transformative, ushering in extraordinary outcomes for Eurobank Cyprus:

Boosted Efficiency: The automated process drastically reduced cheque-clearing times, significantly enhancing operational efficiency.

Error Reduction: The API integration with Temenos - T24 eliminated the potential for errors, enhancing the accuracy of cheque processing.

Elevated Customer Satisfaction: Customers experienced faster clearing times, which heightened customer satisfaction.

Cost Savings: By streamlining processes and reducing errors, Eurobank Cyprus achieved cost savings in operational expenditures.

Competitive Edge: SmartClear positioned Eurobank Cyprus as an innovative institution, leveraging technology to deliver superior customer experiences.

Conclusion

The collaboration between Eurobank Cyprus and Parallax Works culminated in successfully developing and implementing SmartClear - an advanced cheque-clearing solution that redefined Eurobank Cyprus's cheque-processing landscape.

This case study underscores the significance of innovation and collaboration in driving positive transformation within the banking sector.

Alpha Bank

Alpha Bank

JCC Payment Systems