Challenge: Enhancing Customer Communication and Personalization

Alpha Bank, a leading financial institution, sought a solution that could intelligently communicate with customers and provide personalized financial product recommendations. The bank faced several challenges:

- Generic, untargeted communication methods lead to low customer engagement.

- Lack of real-time, event-based notifications, resulting in delayed or missed opportunities to connect with customers.

- No centralized AI-driven system to analyze customer behavior and preferences for tailored product recommendations.

Alpha Bank needed an advanced solution that could provide personalized, timely, and multi-channel engagement while seamlessly integrating with its existing systems.

The Solution: Implementing Personar for Intelligent Customer Engagement

Parallax Works provided Personar, an AI-driven customer engagement platform designed to analyze customer behavior and deliver targeted, multi-language, and multi-channel personalized messages and alerts to meet Alpha Bank's needs.

Key Features of the Solution

- AI-Driven Personalization

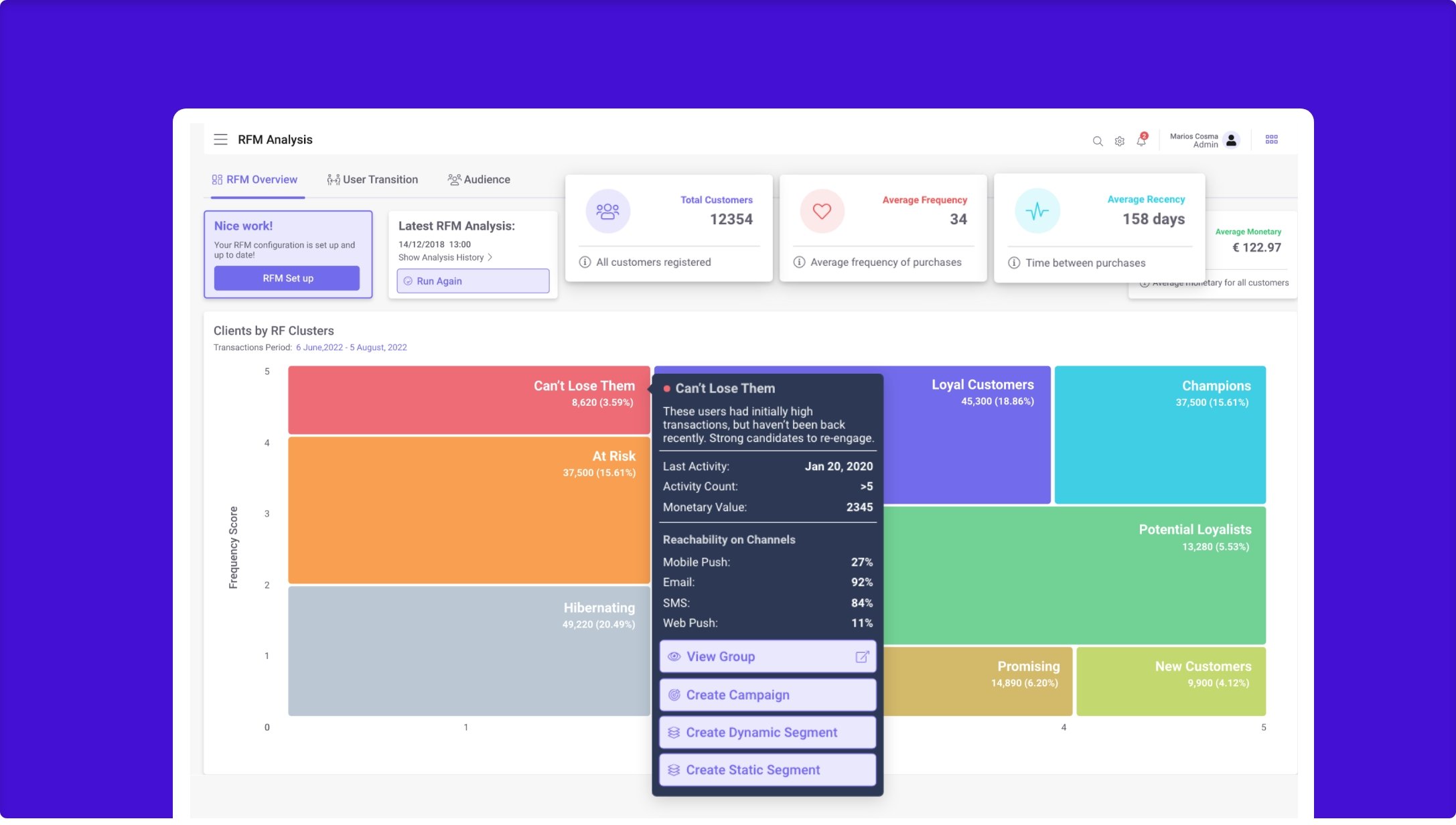

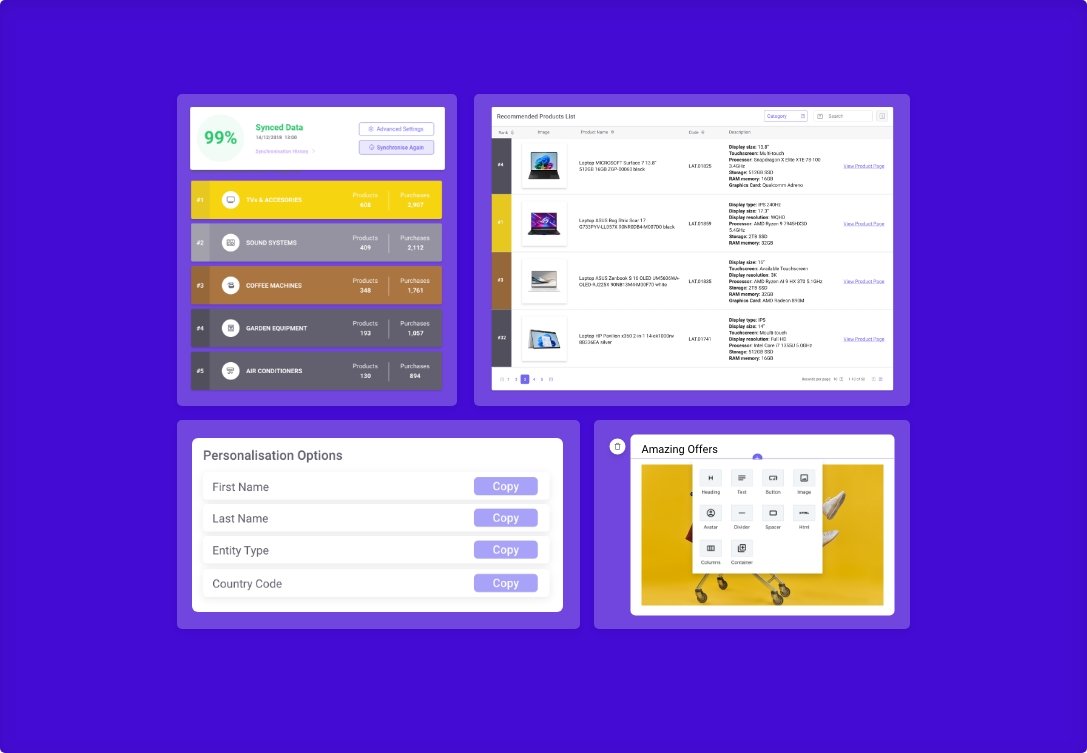

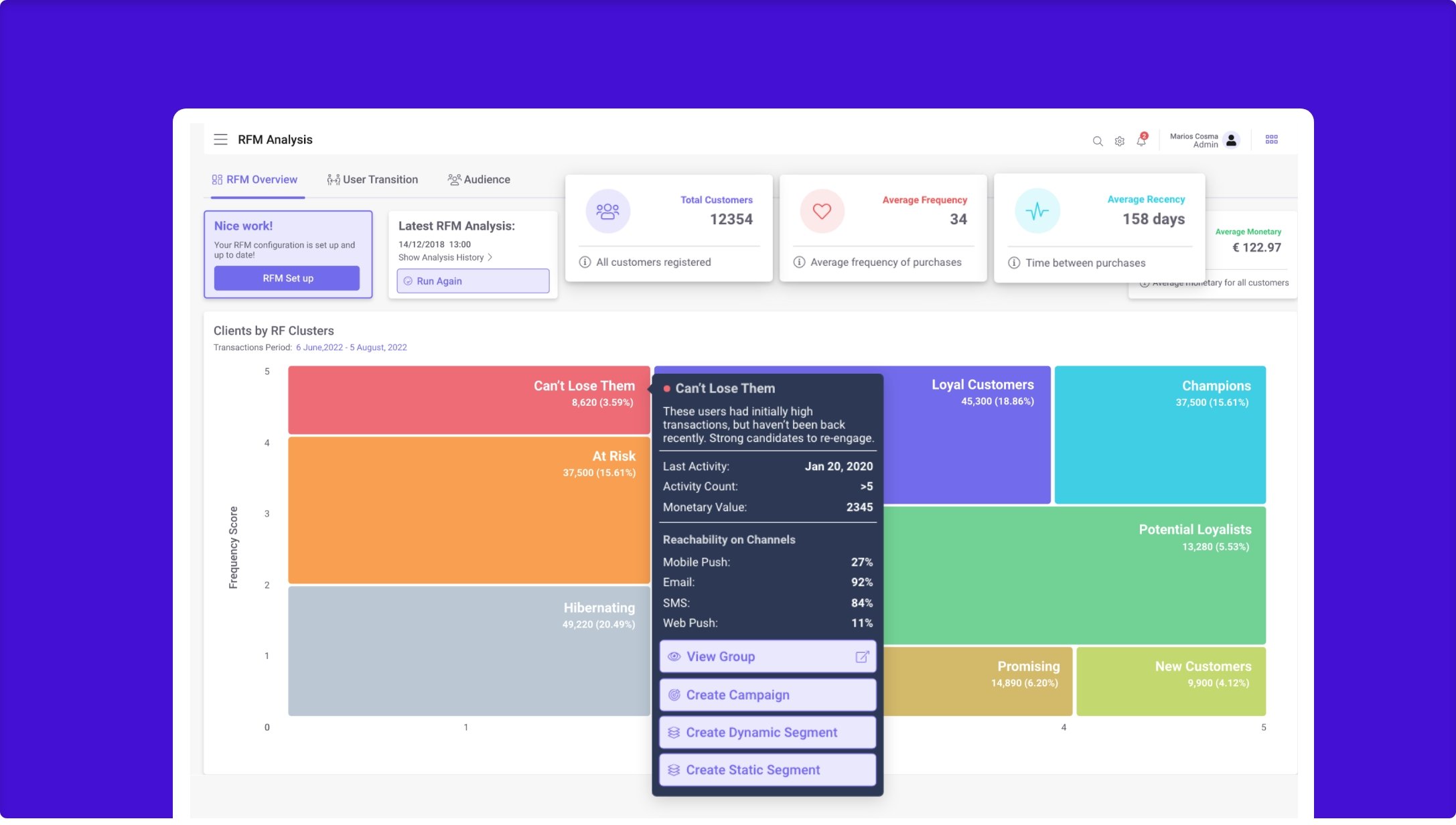

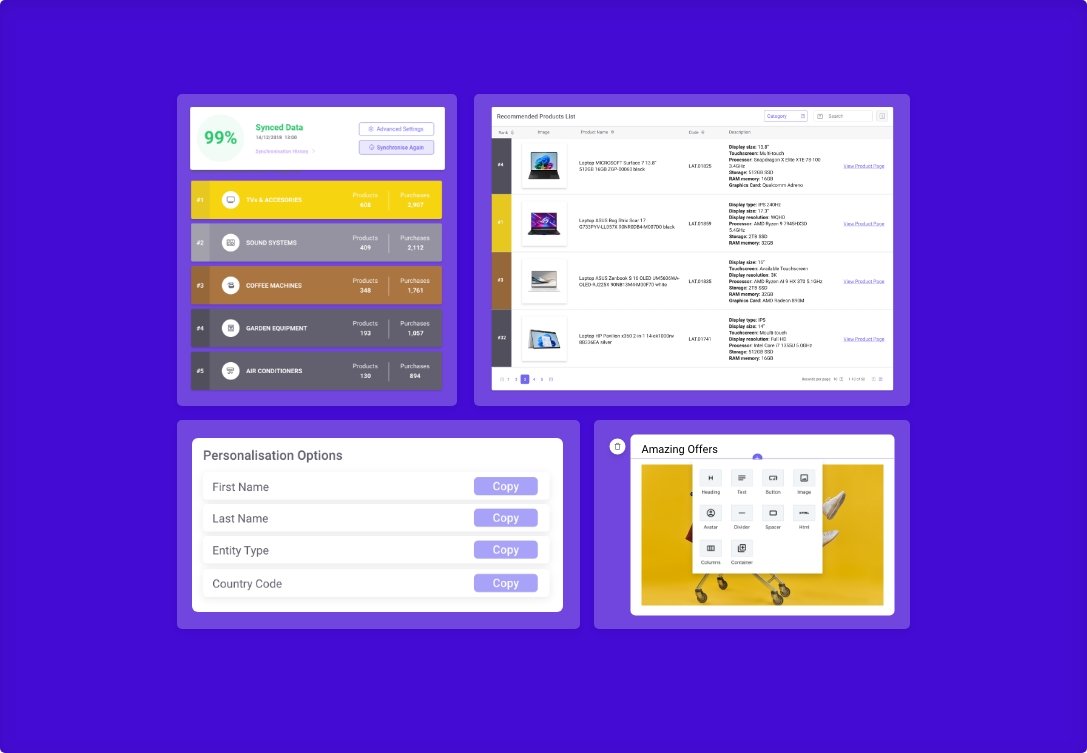

Personar leveraged RFM analysis (Recency, Frequency, and Monetary) and Smart Segmentation to understand each customer's transaction history, spending habits, and behavior, enabling hyper-personalized recommendations.

- Multi-Channel Communication

The platform seamlessly integrated with Alpha Bank's systems to enable real-time engagement via:

- SMS

- Email

- Viber

- WhatsApp

- In-app push notifications

- Advanced Event-Based Alerting

Personar's robust API layer is connected to Alpha Bank's systems to trigger event-driven alerts. Whenever an external system generated an event (e.g., a new transaction, policy update, loan pre-approval, or security alert), Personar instantly sent a personalized notification to the relevant customer.

- Omnichannel Campaign Management

Personar's built-in campaign builder enabled Alpha Bank to launch targeted marketing campaigns across different customer segments, ensuring:

- Customers received relevant offers based on their needs.

- Messages were delivered via the most effective communication channels.

- Engagement rates improved with timely and personalized outreach.

Implementation Process

Assessment and Strategy Development

Business Analysis: Parallax Works conducted an in-depth analysis of Alpha Bank's customer engagement processes, identifying pain points such as low response rates, inefficient communication workflows, and a lack of real-time personalization.

Customer Segmentation & Data Integration: The bank's customer base was segmented based on age, language, location, transaction behavior, and financial interests to ensure precision targeting.

Phased Development & Deployment

Phase 1: System Integration & AI Training

- Personar was integrated with Alpha Bank's core banking applications, CRM, and transaction systems.

- The AI engine was trained using historical customer data to improve product recommendation accuracy.

Phase 2: Multi-Channel Engagement Setup

- Personalized engagement rules were created for different customer profiles.

- Real-time alerts and marketing campaign workflows were configured.

Phase 3: Testing & Optimization

- A/B testing of different messaging approaches was conducted to determine the most effective content strategies.

- Performance tracking and refinements were implemented based on engagement analytics.

Training & Onboarding

Parallax Works provided comprehensive training for Alpha Bank's marketing and customer support teams to leverage Personar's advanced features and maximize its impact.

Optimization & Features

- Real-Time Customer Engagement

- Automated Notifications: Customers received instant alerts about new offers, loan approvals, security updates, and account changes.

- Hyper-Personalized Messages: Each customer received product recommendations based on their behavior and financial history.

- Seamless Integration with Bank Systems

- Core Banking Integration: Real-time synchronization with Alpha Bank's transaction and customer management systems.

- AI-Powered Recommendations: Using machine learning models, Personar provided financial product suggestions that matched customers' spending and saving behaviors.

- Enhanced Customer Experience

- Multi-Language Support: Personalized messages were delivered in customers' preferred languages.

- Engagement Across Channels: Customers received messages on their preferred platforms via SMS, Viber, email, WhatsApp, or push notifications.

- Advanced Reporting & Analytics

- Campaign Performance Tracking: Personar's dashboard provided insights into customer engagement, conversion rates, and campaign effectiveness.

- AI-Powered Insights: The system continuously learned and adapted to improve messaging strategies.

Project Management & Results

Parallax Works managed the Personar implementation efficiently in six months, ensuring seamless integration without disrupting Alpha Bank's operations.

Key Results Achieved

- Increased Customer Engagement: Personalized outreach and real-time notifications increased interaction rates.

- Growth in Product Uptake: Customers were more likely to adopt financial products recommended based on their behavior.

- Reduced Manual Effort: Automated messaging and AI-driven segmentation reduced the workload on marketing and customer service teams.

- Enhanced Customer Satisfaction: Effective communication improved customer trust and loyalty.

Conclusion

By implementing Personar, Alpha Bank successfully modernized its customer engagement strategy, delivering:

- Personalized financial recommendations

- Multi-channel, real-time communication

- Event-driven, AI-powered alerts and campaigns

With these improvements, Alpha Bank strengthened customer relationships, increased product adoption, and enhanced operational efficiency, reinforcing its position as a forward-thinking financial institution.