CDB Bank, also known as the Cyprus Development Bank Public Company Ltd, has been a prominent financial institution since 1963.

Today, it is one of Cyprus's leading niche financial institutions, providing innovative financial solutions to diverse clients. CDB Bank identified the need to simplify and standardize the process of authorizing signatories for their customers' cheque transactions.

The Goal

The primary objective for CDB Bank was to create a solution that could assign specific conditions to signatories and integrate them seamlessly into the mandates of the existing cheque-clearing system used by the bank. This initiative aimed to provide clear guidelines to bank employees regarding the number of signatures required for each cheque transaction based on the cheque's value. CDB Bank intended to streamline transaction efficiency, reduce processing time, and ensure the highest level of accuracy.

The Process & Functionalities

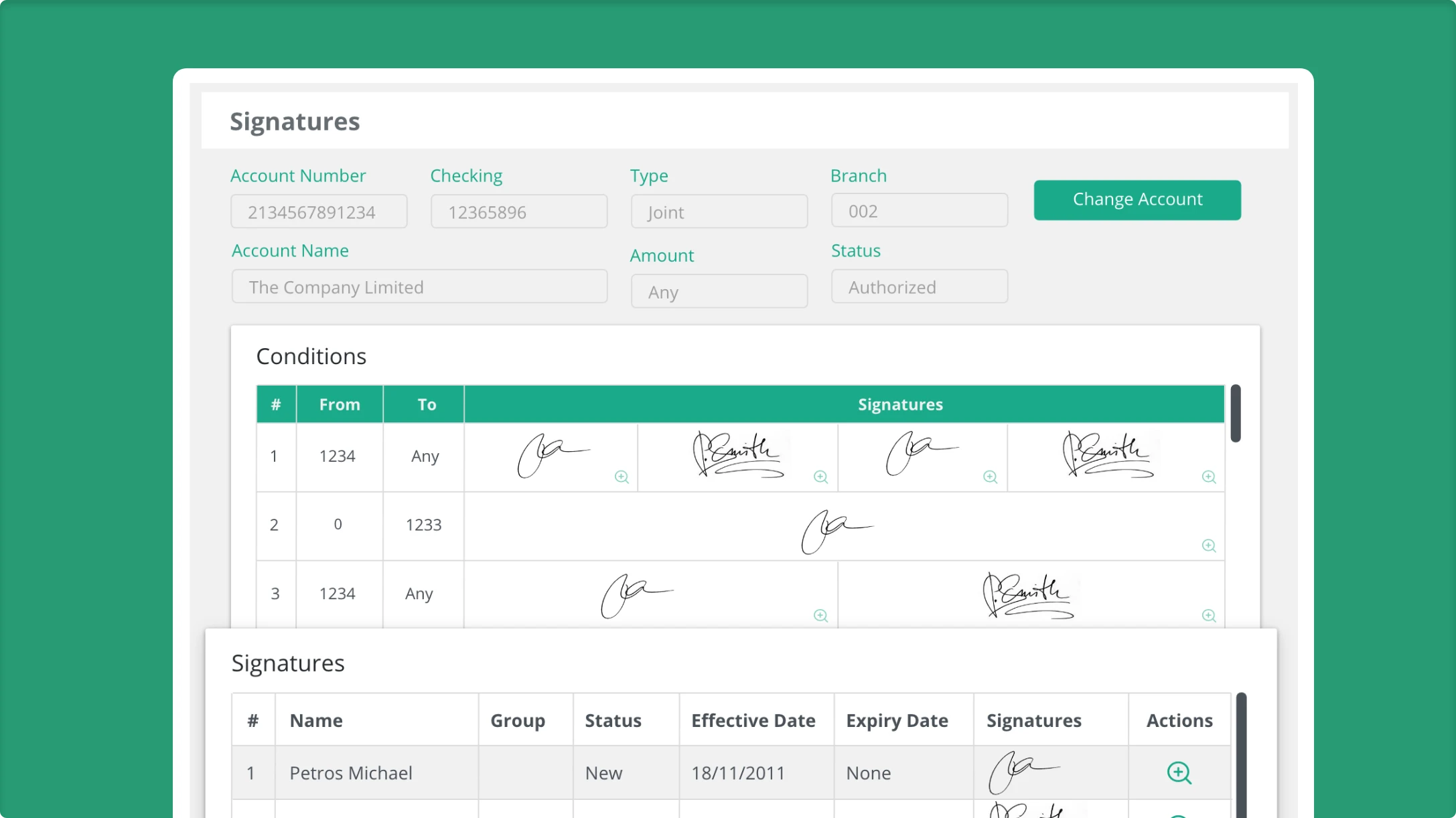

Parallax Works customized iSign (a signature verification web application) to optimize signatory authorization.

Integration with SmartClear: iSign, through API integration with SmartClear, synchronizes client accounts.

Efficient Signature Capture Process: iSign streamlines the signature capture process with its intuitive and easy-to-use User Interface. It empowers bank staff to capture clients' signatures through scanning and utilize the layout functionality to enable automated recognition. Moreover, it enhances operational efficiency and provides a reliable, secure, and professional signature management approach.

Conditional Signatories for Cheque Processing: iSign offers customizable signature conditions based on each cheque amount, ensuring only authorized individuals have the authority to sign a cheque.

The Impact

Implementing iSign at CDB Bank has introduced a new level of efficiency, precision, simplicity, empowerment, adaptability, and security, significantly enhancing the banking experience.

Efficiency: iSign expedites transaction processing by customizing conditions based on cheque values.

Precision: Utilizing advanced signature recognition technology within a layout feature minimizes errors and enhances transaction accuracy.

Simplicity: The streamlined workflow from account receipt to transaction conditions simplifies operations for bank employees and improves customer satisfaction.

Security: iSign ensures secure transactions by verifying mandatory signatures based on the transaction amount and ensuring proper signatures are in place before proceeding.

Conclusion

Parallax and CDB Bank have redefined signatory authorization with iSign - a safer, more efficient, and customer-centric banking experience.

iSign streamlines workflow processes empowers employees, and benefits the bank and its customers.

Alpha Bank

Alpha Bank

JCC Payment Systems