ParallaxWorks was awarded the project for replacement of the existing Cyprus Electronic Cheque Clearing System (ECCS). The ECCS, also known as the Cheque Truncation System, which was initially implemented in 2010, aimed to modernize and streamline cheque clearing, enabling local banking institutions bridge the gap between technology and business.

Through collaborative efforts with the members of the Cyprus Clearing House (CCH), ParallaxWorks successfully managed the project's design and architecture, analysis, software development, installation, implementation, deployment, training, maintenance and support.

ParallaxWorks demonstrated exceptional dedication and technical expertise by delivering the ECCS project within a tight timeframe of just six months from the award.

The Goal: Accelerating Clearing and Enhancing Efficiency

The ECCS project aims to revolutionize cheque processing by introducing a new era of efficiency and speed. ParallaxWorks created a cutting-edge system to deliver exceptional advantages to cheques clearing process.

The Process: Pioneering a Cutting-Edge ECCS

ParallaxWorks utilized advanced technologies and robust encryption protocols to realize its vision of a transformative ECCS. The system provides the following key benefits:

Accelerated Clearing Cycle: The ECCS empowers banks to manage the processing of cheques within a short period, revolutionizing operational efficiency to the cheques clearing.

Enhanced Reconciliation and Verification: The system simplifies data storage and retrieval with centralized image archiving, reducing manual tasks and errors for streamlined operations.

Elevated Service: The ECCS offers almost real-time tracking and visibility of cheques, significantly reducing turn-around time (TAT), improving reconciliation, and fortifying fraud prevention.

Enchanced Security: DDoS, Firewall, WAF, IPSec VPN, and daily encrypted backups were utilized to guarantee maximum uptime, data protection, and integrity.

Seamless Integration: The system can easily integrate with other systems and platforms, streamlining banks’ operations and workflows. API integration is also supported.

Improved Compliance: The ECCS complies with regulatory requirements through features such as audit trails, data retention policies, and access controls.

Increased Scalability: The application is designed to be scalable, allowing additional resources to be allocated when needed to ensure a smooth system operation.

Modular Architecture: The ECCS’s modular architecture allows for quick development and implementation of additional features as required.

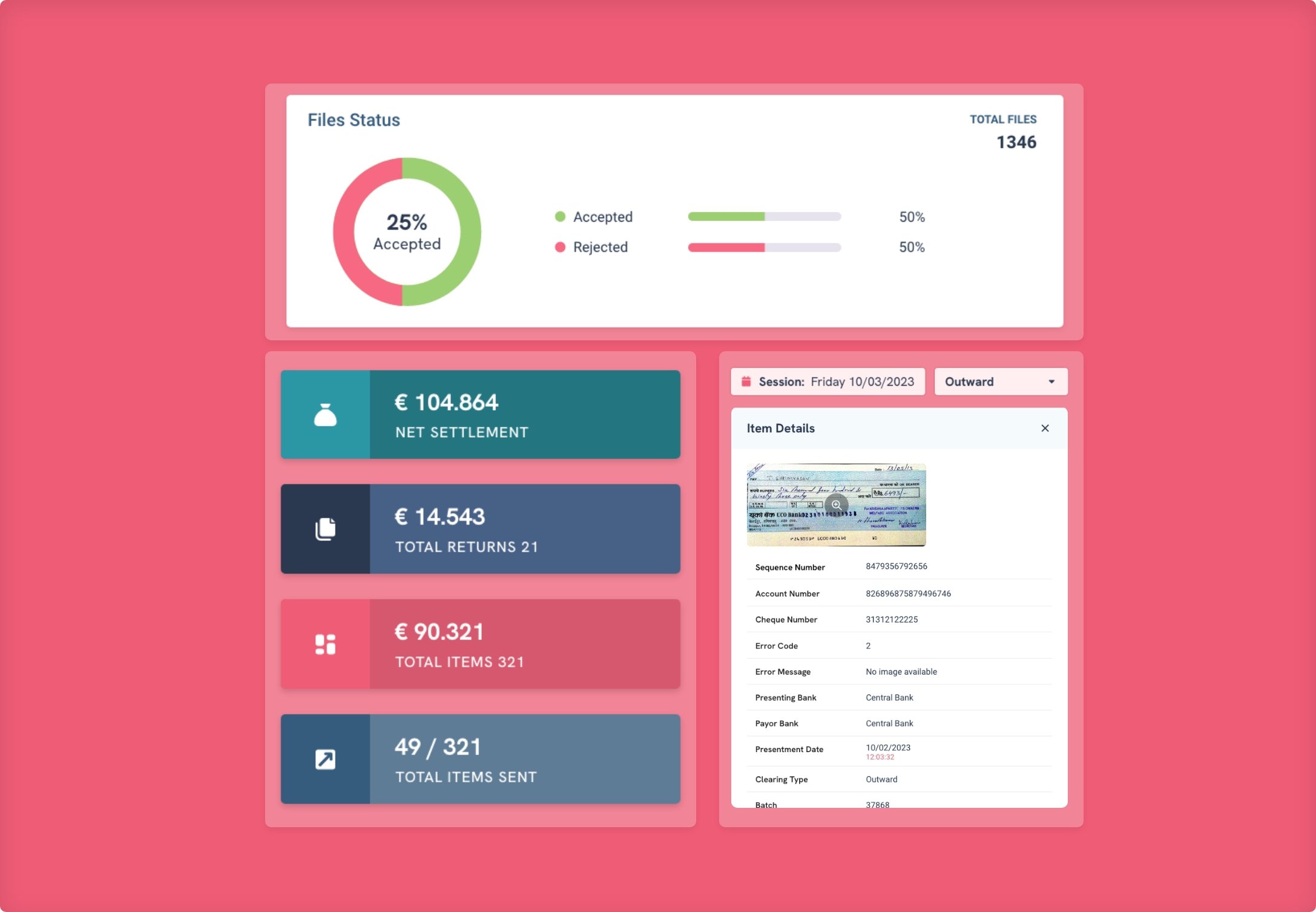

Improved User Experience: The ECCS's modern and intuitive interface facilitates quicker navigation and easy access to information for an enhanced user experience.

Better Customer Support: The application’s support team is always available to assist the CCH participating banks with any queries or issues they may have.

The operation of ECCS serves the banks-members of the CCH and respects its regulations regarding the clearing of cheques with advanced security and technology.

The Future of ECCS

ParallaxWorks designed the ECCS with adaptability in mind, ensuring it can accommodate future growth and evolving needs. As a result, the ECCS represents a future-ready solution that will continue to enhance cheque processing for years to come.

Conclusion

Through its ECCS project, ParallaxWorks readjusted Cyprus's banking landscape, delivering swift and efficient cheque-clearing experiences. By adopting Parallax Works’ Cheque Clearing System, local banking institutions can access a secure and digital cheque-clearing process fortifying against fraud.

ParallaxWorks' commitment to innovation, security, professionalism, and userfriendliness has set a new industry benchmark, establishing the new ECCS as a resounding success in Cyprus' financial sector.

Alpha Bank

Alpha Bank

JCC Payment Systems