Challenge: Optimizing Customer Management and Daily Operations

Alpha Bank, the fourth-largest bank in Greece, with subsidiaries in Cyprus, Romania, and the United Kingdom, sought a robust CRM system to streamline daily operations, improve customer service, and enhance business development opportunities.

Key Challenges:

- Fragmented customer data across multiple systems, making it difficult to gain a 360-degree view of each client’s financial profile.

- Limited visibility into campaign performance, agent productivity, and sales effectiveness.

- Inefficient lead management and follow-up processes, leading to missed business opportunities.

- Manual, time-consuming workflows for customer verification, service requests, and agent task management.

- Lack of integration with telephony systems, making contact center interactions less efficient.

To overcome these challenges, Alpha Bank partnered with Parallax Works to implement Clienti CRM, a tailored, AI-driven customer relationship management solution designed to enhance customer engagement, automate workflows, enhance operational efficiency, and provide deep business insights.

The Solution: Implementing Clienti CRM for a Unified Customer Experience

To address Alpha Bank’s challenges, Parallax Works customized Clienti CRM to seamlessly integrate with the bank’s existing infrastructure and provide:

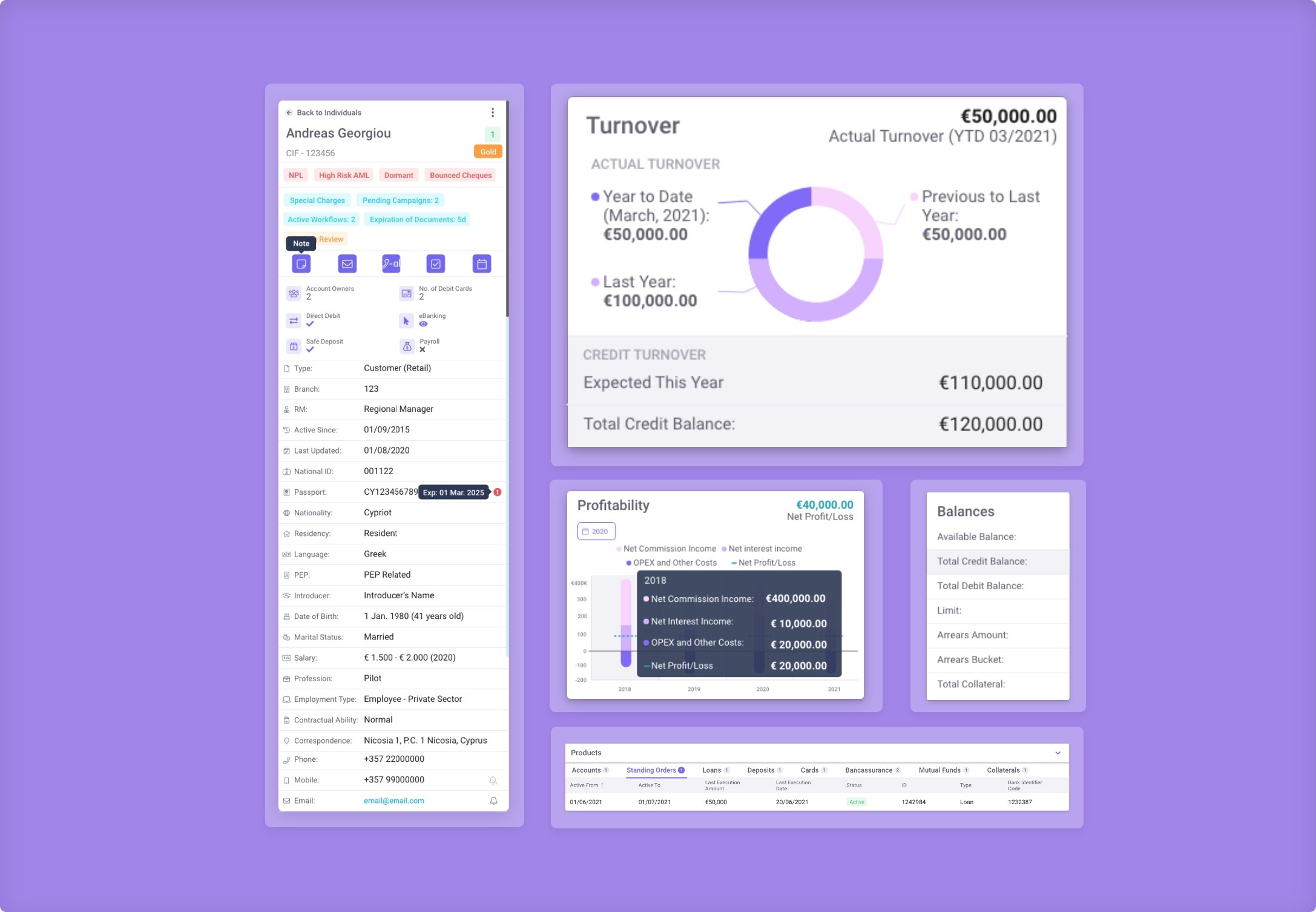

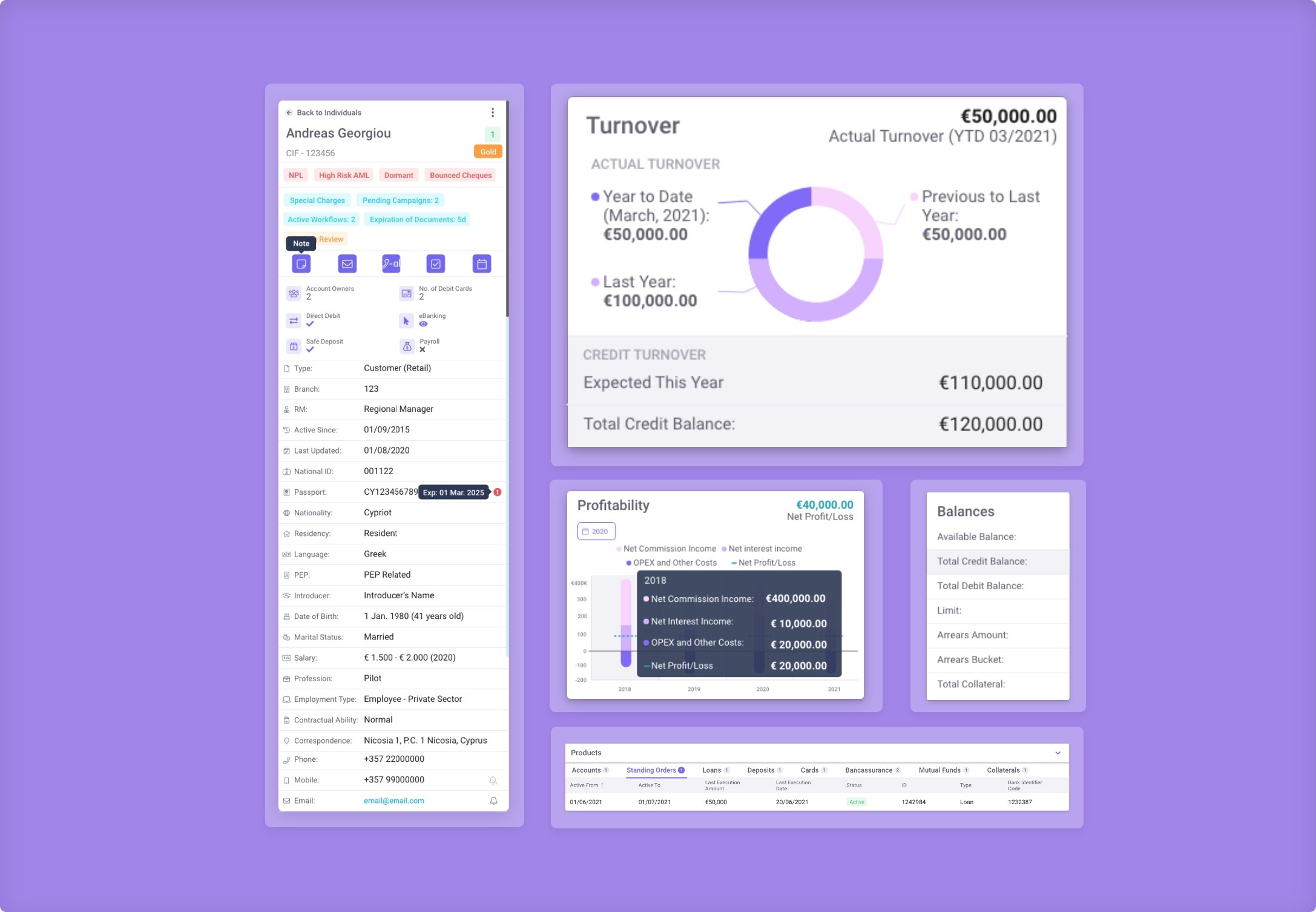

- A Comprehensive 360-degree Customer & Corporate View

- Clienti unified customer data from multiple sources into a single platform, offering employees a complete financial and relationship profile of each client. This included:

- Customer personal and KYC details

- Customer portfolio details, including accounts, loans, and investments.

- Related corporate connections, offering a holistic view of business clients.

- Interaction history, enabling employees to provide personalized financial advice and support.

- Advanced Lead & Campaign Management

- Automated Campaign Creation: Administrators could set up campaigns, define success criteria, and build workflows for agents.

- Efficient Lead Assignment: Leads were automatically distributed per branch and agent, ensuring a structured follow-up process.

- Real-Time KPI Tracking: Each branch had its own dashboard, allowing managers to monitor agent performance, campaign success rates, and conversion trends.

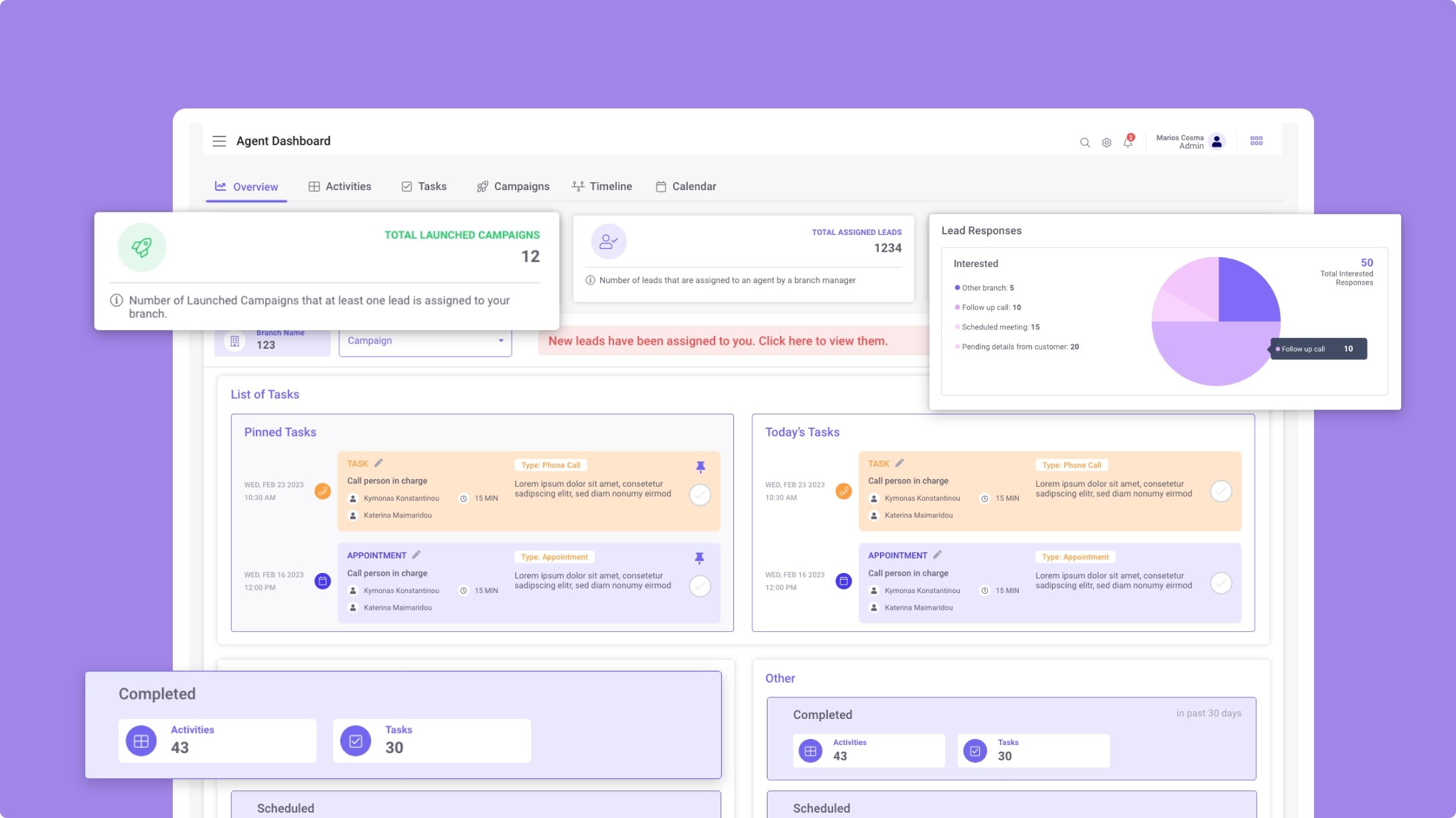

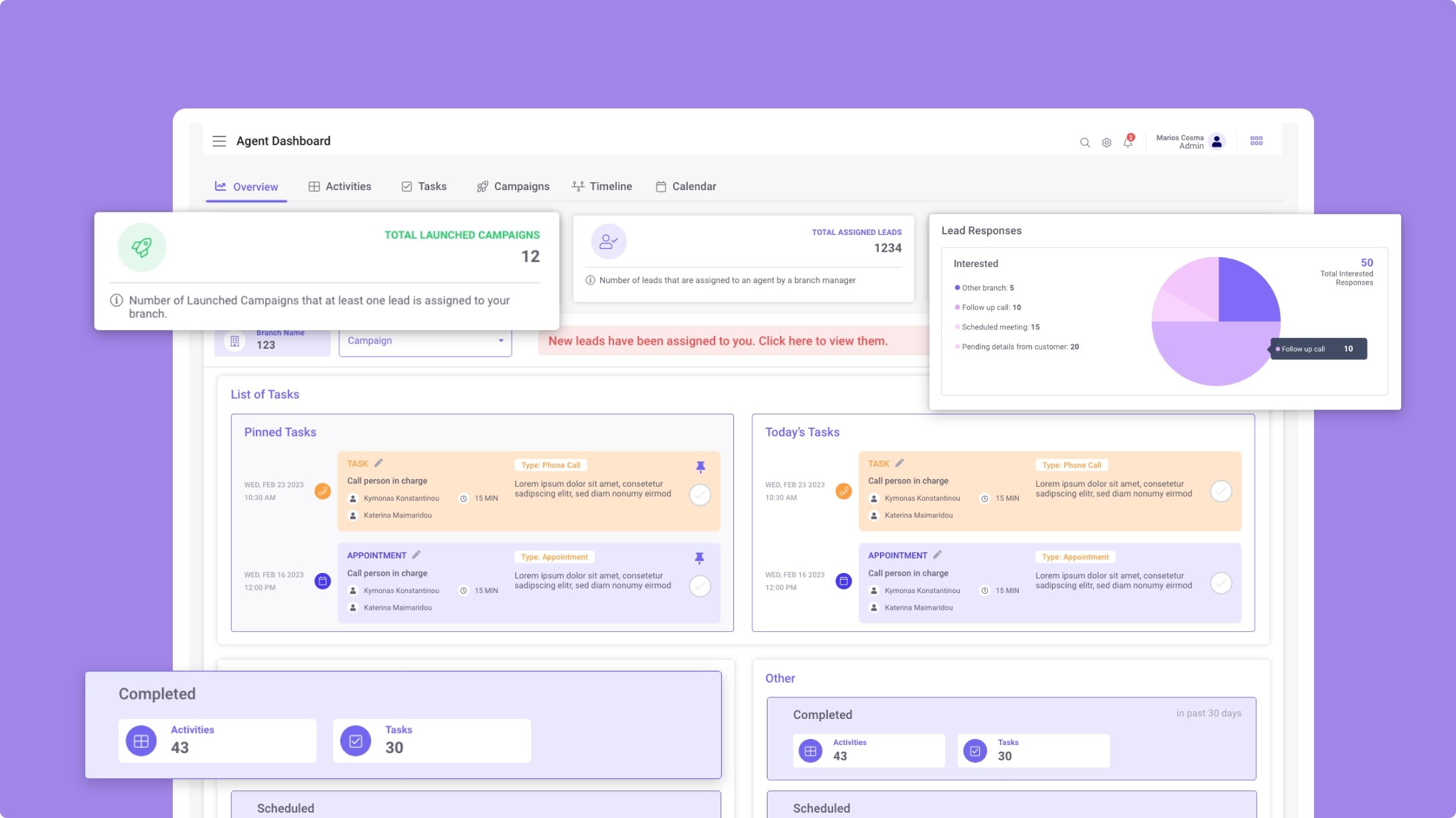

- Dedicated Workspaces for Agents & Managers

Clienti introduced a hierarchical workspace system, giving each team member a tailored view of their responsibilities:

- Agents received a personalized dashboard with tasks, appointments, lead management tools, and workflows.

- Branch Managers had an overview of their team’s performance, lead conversion rates, and campaign impact.

- Directors & Executives gained strategic insights through high-level sales KPIs and operational reports.

- Seamless Telephony System Integration

Clienti integrated with Alpha Bank’s telephony system, allowing contact center agents to:

- Verify customers through an automated workflow, ensuring security and compliance.

- Instantly retrieve customer profiles and interaction history, improving service efficiency.

- Log and track customer interactions, providing valuable insights for future engagements.

Implementation Process

Phase 1: Needs Assessment & Customization

Parallax Works conducted an in-depth business analysis of Alpha Bank’s existing processes, identifying inefficiencies and mapping key CRM functionalities to their business objectives.

Phase 2: System Development & Integration

- Clienti was customized and integrated with Alpha Bank’s core banking systems, telephony infrastructure, and marketing tools.

- Automated workflows were developed to improve lead assignment, campaign execution, and customer service processes.

Phase 3: Testing & Deployment

- The system was tested in phases to ensure seamless integration with Alpha Bank’s daily operations.

- A pilot program was rolled out to select branches, allowing real-time feedback and iterative improvements.

Phase 4: Training & Optimization

- Parallax Works provided comprehensive training to branch managers, agents, and directors, ensuring they could leverage Clienti’s full capabilities.

- Post-launch monitoring and support ensured smooth adoption and continuous optimization.

Results & Key Benefits

- Enhanced Customer Engagement & Personalization

- With a 360-degree customer view, Alpha Bank employees could provide tailored financial recommendations, boosting customer satisfaction and loyalty.

- Improved Lead Management & Sales Efficiency

- Automated lead assignment and structured workflows increased conversion rates and reduced follow-up delays.

- Real-Time Performance Insights for Better Decision-Making

- Branch dashboards gave managers real-time metrics on agent performance, lead status, and campaign effectiveness.

- Increased Operational Efficiency & Reduced Manual Workloads

- Automated workflows and telephony integration significantly reduced agent workload, allowing them to focus on value-added customer interactions.

- Seamless Communication Across Teams

- With dedicated workspaces for agents, managers, and directors, Clienti ensured better collaboration and a clear hierarchy of responsibilities.

- Scalability for Future Growth

- The modular architecture of Clienti allowed Alpha Bank to expand its CRM capabilities as needed, ensuring long-term adaptability.

Conclusion: A Game-Changer for Alpha Bank

By implementing Clienti CRM, Alpha Bank successfully optimized daily operations, enhanced customer service, and improved lead management. The automation of workflows, intelligent customer segmentation, and real-time performance tracking have empowered the bank to:

- Provide personalized customer experiences at scale.

- Streamline operations and eliminate inefficiencies.

- Gain actionable insights to drive revenue growth.